What is SIP : If you’re looking for a simple and effective way to grow your wealth, Systematic Investment Plan (SIP) is one of the best investment strategies to consider.

It allows you to invest small amounts regularly in mutual funds helping you build a strong financial future without needing a large sum upfront.

In this guide, we’ll cover what SIP is, how it works, and why it’s a smart choice for investors.

What is SIP?

SIP (Systematic Investment Plan) is an investment method where you invest a fixed amount at regular intervals (monthly, quarterly, etc.) into a mutual fund. Instead of investing a lump sum, SIP helps you build wealth gradually through consistent contributions. It’s like a disciplined savings plan but with higher returns potential than traditional savings accounts.

Key Features of SIP:

✅ Start with as little as ₹500 per month

✅ Automatic deductions from your bank account

✅ No need to time the market

✅ Helps you take advantage of compounding

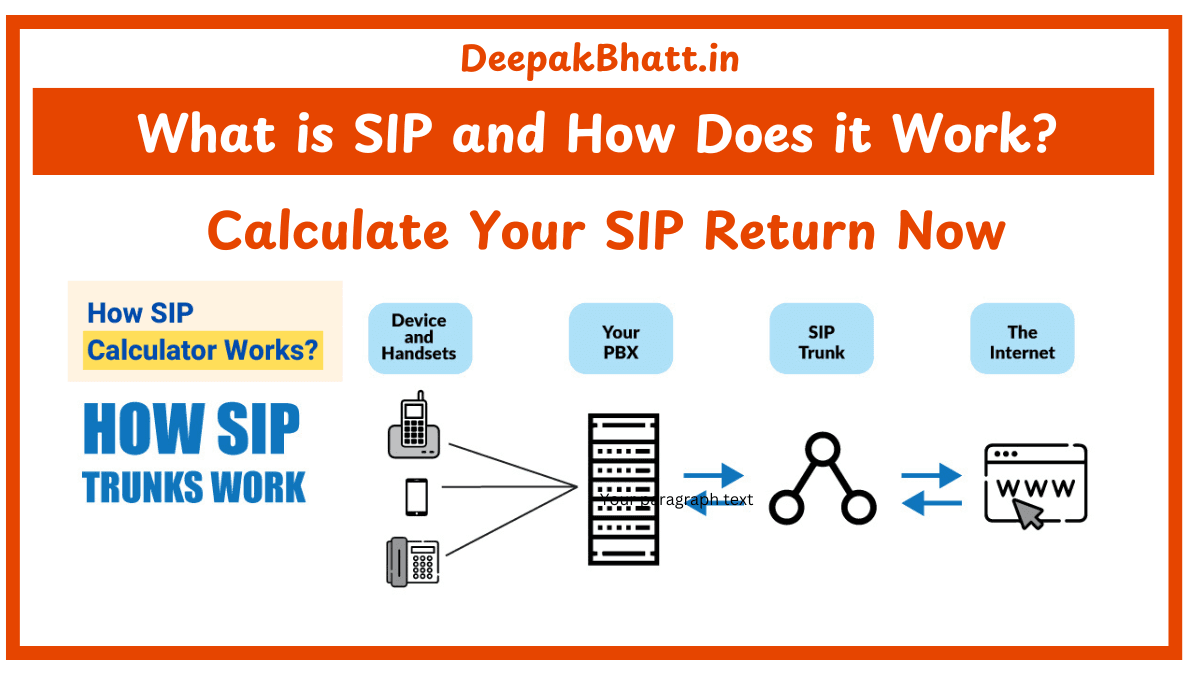

How Does SIP Work?

1️⃣ Select a Mutual Fund

The first step is to choose a mutual fund based on your financial goals and risk tolerance. Options include:

- Equity Funds (Higher risk, higher returns)

- Debt Funds (Lower risk, stable returns)

- Hybrid Funds (Balanced risk & return)

2️⃣ Choose Your SIP Amount & Frequency

Decide how much you want to invest (e.g., ₹1,000/month, ₹5,000/month, etc.). The amount is automatically deducted from your bank account on a chosen date.

3️⃣ Purchase Mutual Fund Units

Your SIP amount is used to buy mutual fund units based on the Net Asset Value (NAV) of that day. When markets are down, you get more units; when markets are up, you get fewer units—this is called rupee cost averaging.

4️⃣ Let Compounding Work Its Magic ⏳

As your investments grow, you earn returns on your returns, creating a compounding effect. Over time, this helps multiply your wealth significantly.

Example: How SIP Grows Your Money

If you invest ₹5,000 per month in a mutual fund with an average return of 12% per year, here’s how your investment can grow over time:

| Years | Total Investment | Estimated Returns | Total Value |

|---|---|---|---|

| 5 Years | ₹3,00,000 | ₹1,05,000 | ₹4,05,000 |

| 10 Years | ₹6,00,000 | ₹5,32,000 | ₹11,32,000 |

| 15 Years | ₹9,00,000 | ₹15,08,000 | ₹24,08,000 |

| 20 Years | ₹12,00,000 | ₹35,65,000 | ₹47,65,000 |

Imagine if you increase your SIP contribution over time—the returns would be even higher!

Benefits of SIP Investing :

✅ Affordable & Easy to Start

You can start with just ₹500 or ₹1,000 per month and gradually increase your investment.

✅ No Need to Time the Market

SIP invests at different market levels, ensuring you buy more units when prices are low and fewer when prices are high.

✅ Power of Compounding

Over the long term, your money grows exponentially, thanks to compounded returns.

✅ High Liquidity & Flexibility

You can increase, decrease, or stop SIP anytime. Unlike fixed deposits, SIPs offer better liquidity.

✅ Tax Benefits

Some SIPs (like ELSS funds) offer tax-saving benefits under Section 80C, helping you save taxes while growing wealth.

Is SIP Right for You?

SIP is an excellent option for:

✔ Salaried individuals looking for disciplined investing

✔ Beginners who want steady growth without market timing

✔ Investors planning for long-term goals like buying a house, education, or retirement

Conclusion: Start Your SIP Today

SIP is a safe, flexible, and smart way to grow your wealth. Whether you are new to investing or an experienced investor, SIP offers the perfect balance of low risk, high returns, and convenience.

💡 The best time to start SIP is NOW! The earlier you invest, the more you benefit from compounding and rupee cost averaging.

Ready to start? Let me know if you need help choosing the best SIP for your financial goals! 😊

आप सभी का मेरी वेबसाइट पर स्वागत है। मैं Blogging, earning money online और अन्य Categories से संबंधित Post Updates करता रहता हूँ। यहाँ आपको बहुत अच्छी Post पढ़ने को मिलेंगी। जहाँ से आप बहुत सारा Knowladge बढ़ा सकते हैं। आप हमारी website और Social Media के माध्यम से हमसे जुड़ सकते हैं। धन्यवाद