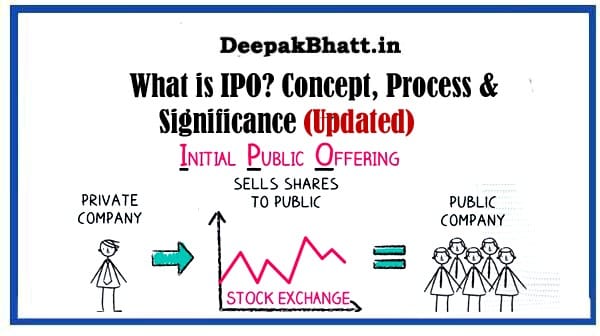

What is IPO In the dynamic landscape of finance, Initial Public Offerings (IPOs) represent

A milestone for companies seeking to tap into the vast ocean of public markets.

An IPO marks the transition from a privately held entity to a publicly traded company, offering shares to the investing public for the first time.

This comprehensive guide aims to unravel the intricacies of IPOs, shedding light on their significance, processes, implications, and the broader impact on companies venturing into the realm of public markets.

Free Course:

What is IPO? Initial Public Offerings (IPOs)

An IPO is a transformative event in the life of a company, allowing it to raise capital by offering shares to the public.

It is a strategic move that not only provides financial resources for the company’s growth but also offers investors the opportunity to become shareholders in a company poised for expansion and success.

Key Components of an IPO: What is IPO?

Offering Shares: Companies issue a portion of their ownership (shares) to the public for purchase.

Underwriters: Investment banks or financial institutions play a crucial role in underwriting the IPO, guiding the company through the process and facilitating the marketing and distribution of shares.

Prospectus: A comprehensive document detailing the company’s financials, operations, risks, and future prospects is presented to potential investors in the form of a prospectus.

Pricing: The offering price of shares is determined through a process that considers market demand and the company’s valuation.

The IPO Process

The journey from a private company to a publicly traded entity involves a well-defined process. Here are the key stages in an IPO:

1. Preparing for the IPO:

Assessment: The company evaluates its readiness for the public markets, considering factors such as financial performance, corporate governance, and market conditions.

Selection of Underwriters: The company chooses investment banks to act as underwriters, guiding it through the IPO process.

2. Drafting the Prospectus:

Due Diligence: The company conducts thorough due diligence, and underwriters assist in preparing the prospectus a detailed document outlining the business, financials, risks, and management.

Regulatory Filings: The prospectus, along with required regulatory filings, is submitted to the relevant securities regulatory bodies.

3. SEC Review:

Regulatory Approval: The U.S. Securities and Exchange Commission (SEC) reviews the prospectus and other filings, providing feedback and issuing necessary approvals.

4. Roadshow:

Marketing and Promotion: The company, alongside underwriters, conducts a roadshow to market the IPO to potential investors. Management presents the company’s story, financials, and growth prospects.

5. Pricing and Allotment:

Setting the Price: The final offering price is determined based on investor demand and market conditions.

Allotment of Shares: Shares are allocated to institutional and retail investors based on their subscription levels.

6. Debut on the Stock Exchange:

Listing on an Exchange: The company’s shares make their debut on a stock exchange, where they are bought and sold by investors.

First Trading Day: The first day of trading establishes the market value of the company’s shares.

7. Post-IPO Life:

Ongoing Reporting: As a public company, ongoing reporting and compliance with regulatory requirements, including quarterly and annual filings, become standard practices.

Shareholder Communication: The company engages in continuous communication with shareholders, analysts, and the broader financial community.

Significance and Implications of IPOs

1. Capital Infusion:

IPOs provide companies with a substantial influx of capital, which can be used for various purposes such as expansion, research and development, debt repayment, or acquisitions.

2. Liquidity for Early Investors:

Early investors and employees holding shares in the private company gain liquidity, allowing them to sell their shares on the public market.

3. Brand Visibility:

Going public enhances a company’s visibility and credibility. It provides a platform for increased media coverage and exposure, which can contribute to brand recognition.

4. Employee Stock Options:

IPOs can be a lucrative event for employees holding stock options, providing them with an opportunity to realize the value of their equity.

5. Mergers and Acquisitions:

Publicly traded companies may use their stock as a currency for mergers and acquisitions, facilitating strategic expansion.

6. Enhanced Corporate Governance:

Public companies are subject to stricter regulatory oversight, which often leads to enhanced corporate governance practices.

7. Benchmark for Valuation:

Public markets provide a transparent benchmark for the valuation of a company. The stock price becomes a visible indicator of the market’s perception of the company’s value.

Challenges and Considerations

While the benefits of an IPO are significant, companies and investors must navigate various challenges and considerations:

1. Market Volatility:

IPOs can be susceptible to market volatility, impacting the stock’s performance in the initial trading days.

Setting realistic expectations for share prices is crucial. Overvaluation can lead to disappointments for both the company and investors.

3. Increased Scrutiny:

Public companies face heightened scrutiny from regulators, analysts, and the media. This requires a commitment to transparency and accountability.

4. Investor Relations:

Building and maintaining strong investor relations become critical. Effective communication with shareholders is essential for long-term success.

5. Market Conditions:

The timing of an IPO is influenced by market conditions. Unfavorable market conditions may lead companies to postpone or reevaluate their IPO plans.

Evolution and Future Trends

The landscape of IPOs continues to evolve, shaped by changing market dynamics and investor preferences. Here are some emerging trends in the world of IPOs:

1. Direct Listings:

Some companies are opting for direct listings, bypassing the traditional underwriting process and allowing existing shareholders to sell their shares directly to the public.

2. Special Purpose Acquisition Companies (SPACs):

SPACs have gained popularity as an alternative route to going public. These “blank-check” companies raise capital through an IPO with the sole purpose of acquiring an existing private company.

Some companies maintain dual-class share structures, giving founders and insiders more voting power than common shareholders. This structure is perceived differently by investors and governance advocates.

4. Rise of Technology IPOs:

Technology companies, often at the forefront of innovation, continue to dominate the IPO landscape. Investors show a keen interest in companies with disruptive technologies and scalable business models.

5. Increased Regulatory Scrutiny:

Regulatory bodies, recognizing the evolving landscape, may introduce changes to the IPO process to enhance investor protection and market integrity.

Conclusion

In conclusion, an Initial Public Offering marks a transformative moment in the life of a company, opening the doors to public markets and inviting investors to participate in its journey.

The IPO process involves meticulous planning, regulatory scrutiny, and careful navigation of market dynamics. While IPOs offer substantial benefits, they also come with challenges and considerations that companies and investors must address.