Right Mutual Fund : Investing in a Systematic Investment Plan (SIP) is a great way to build long-term wealth. But the key to maximizing returns lies in choosing the right mutual fund!

Right Mutual Fund :

With thousands of options available, how do you pick the best mutual fund for SIP? Don’t worry! In this guide, we’ll break down all the essential factors to help you make the right choice.

1️⃣ Understand Your Investment Goal

Before selecting a mutual fund, ask yourself:

✔ What is your investment purpose? (Retirement, buying a house, child’s education, etc.)

✔ What is your investment horizon? (5 years, 10 years, 20 years?)

✔ What is your risk appetite? (Low, moderate, or high?)

Example:

- If your goal is wealth creation for 15+ years, go for equity funds 🚀

- If you need steady returns with lower risk, choose debt or hybrid funds 🏦

2️⃣ Types of Mutual Funds for SIP

Mutual funds are categorized into different types based on risk and return potential. Let’s explore the best options:

✔ Equity Mutual Funds (High Risk, High Return)

📌 Best for: Long-term wealth creation (10+ years)

📌 Average Return: 12%-15% per annum

📌 Types:

- Large-Cap Funds: Invest in big companies (e.g., HDFC Top 100 Fund)

- Mid-Cap Funds: Invest in medium-sized companies (e.g., Axis Midcap Fund)

- Small-Cap Funds: Invest in high-growth small companies (e.g., SBI Small Cap Fund)

- Flexi-Cap Funds: Invest across all caps (e.g., Parag Parikh Flexi Cap Fund)

🔥 Best for high returns! But requires patience.

✔ Debt Mutual Funds (Low Risk, Low Return)

📌 Best for: Safe & stable returns (3-5 years)

📌 Average Return: 6%-8% per annum

📌 Types:

- Liquid Funds (For short-term needs, e.g., ICICI Prudential Liquid Fund)

- Corporate Bond Funds (For higher fixed returns, e.g., HDFC Corporate Bond Fund)

💡 Best for conservative investors who want stable returns.

✔ Hybrid Mutual Funds (Medium Risk, Balanced Return)

📌 Best for: Moderate-risk investors (5-7 years)

📌 Average Return: 8%-12% per annum

📌 Types:

- Aggressive Hybrid Funds: 65% equity + 35% debt

- Balanced Advantage Funds: Dynamic allocation between equity & debt

💡 Best for investors who want a mix of growth & stability!

3️⃣ How to Compare & Select the Best SIP Fund?

To pick the best mutual fund, check these 5 key factors:

✅ 1. Fund Performance (Past Returns)

✔ Check 3-year, 5-year, and 10-year returns

✔ Compare with benchmark & category average

✔ Choose funds that have consistently outperformed

💡 Example: A fund giving 14% return for 10 years is better than one giving 16% in 2 years but underperforming later.

✅ 2. Expense Ratio (Lower is Better)

✔ Expense ratio is the fee charged by the fund house

✔ Lower expense ratio = higher returns for you!

💡 Tip: Choose funds with an expense ratio below 1% for better cost efficiency.

✅ 3. Fund Manager & AMC Reputation

✔ A good fund manager ensures better returns

✔ Top AMCs: SBI, HDFC, ICICI, Mirae Asset, Axis, Kotak

💡 Tip: Check fund manager’s track record & years of experience.

✅ 4. Assets Under Management (AUM)

✔ Higher AUM = More trust & stability

✔ Ideal AUM: ₹5,000 Cr – ₹50,000 Cr

💡 Tip: Avoid too new funds with very low AUM.

✅ 5. Risk & Volatility

✔ Check Standard Deviation & Beta (Lower = Less Risk)

✔ Avoid highly volatile funds if you’re a beginner

💡 Tip: Choose large-cap or balanced funds for low volatility.

4️⃣ Best Mutual Funds for SIP (2025)

Here are some top-performing SIP funds in different categories:

✔ Best Large Cap Funds (Stable Growth)

🔹 Mirae Asset Large Cap Fund – 13.5% (5Y CAGR)

🔹 HDFC Top 100 Fund – 12.9% (5Y CAGR)

✔ Best Mid Cap Funds (High Growth)

🔹 Axis Midcap Fund – 18.2% (5Y CAGR)

🔹 PGIM India Midcap Fund – 19.8% (5Y CAGR)

✔ Best Small Cap Funds (Aggressive Growth)

🔹 Nippon India Small Cap Fund – 21.4% (5Y CAGR)

🔹 SBI Small Cap Fund – 19.7% (5Y CAGR)

✔ Best ELSS (Tax Saving Funds)

🔹 Axis Long Term Equity Fund – 14.2% (5Y CAGR)

🔹 Mirae Asset Tax Saver Fund – 13.8% (5Y CAGR)

📌 Note: Returns are based on past data & can change over time. Always check before investing!

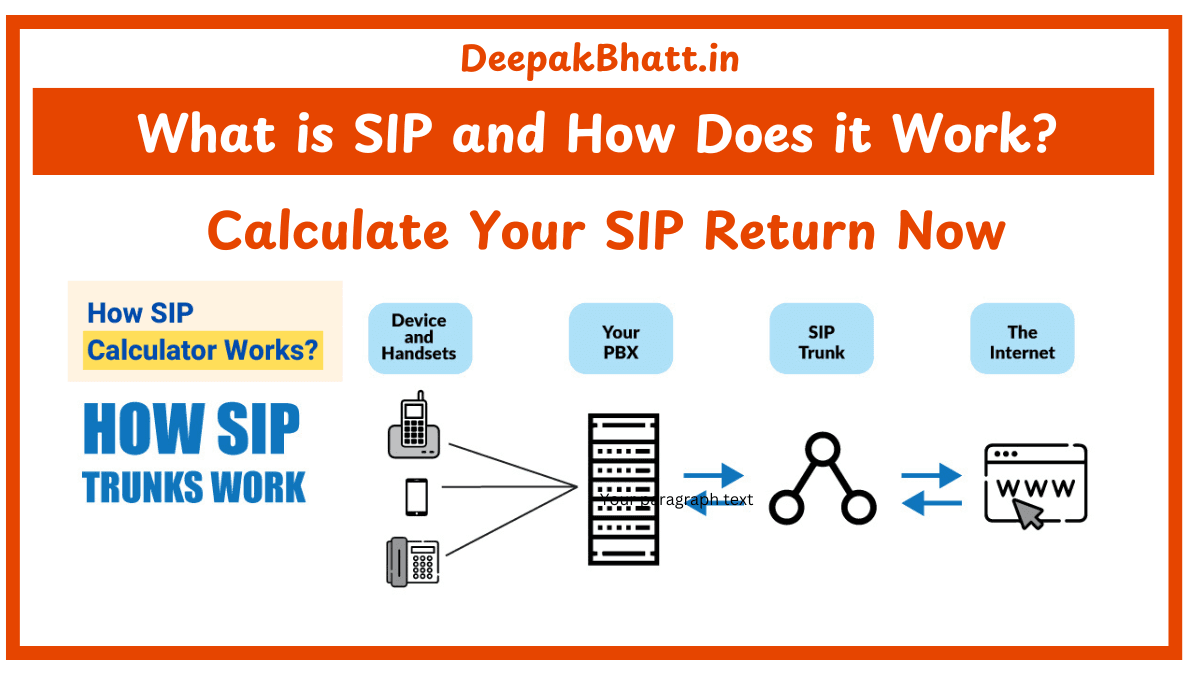

5️⃣ SIP Calculator: How Much Can You Earn?

Want to know how much your SIP can grow? Use this SIP Calculator 👇

🔗 SIP Calculator

📌 Example Calculation:

- ₹5,000 SIP for 20 years at 12% return → ₹50.4 Lakhs!

- ₹10,000 SIP for 25 years at 12% return → ₹1.5 Crore!

💡 Tip: Start early, invest consistently, and let compounding work!

6️⃣ Conclusion: Choose Wisely & Invest Smartly!

🔹 Identify your goal (Wealth, stability, tax-saving)

🔹 Select the right fund (Equity for high growth, Hybrid for balance)

🔹 Compare funds based on returns, risk, & expense ratio

🔹 Invest consistently & stay long-term!

Final Advice: The best mutual fund for SIP is the one that matches your goal & risk profile!

💰 Start your SIP today & build a strong financial future!