Private Equity In the dynamic landscape of finance and investments (PE)

Stands as a formidable force, reshaping the ownership landscape and steering capital towards untapped opportunities.

This distinct form of investment, characterized by direct ownership in private companies, plays a pivotal role in shaping the growth trajectory of businesses and generating substantial returns for investors.

Free Udemy Course:

JavaScript Pro: Advanced Concepts

In this comprehensive blog post, we embark on a journey into the realm of Private Equity, peeling back its layers to reveal the intricacies that define this influential financial instrument.

Deciphering the Essence

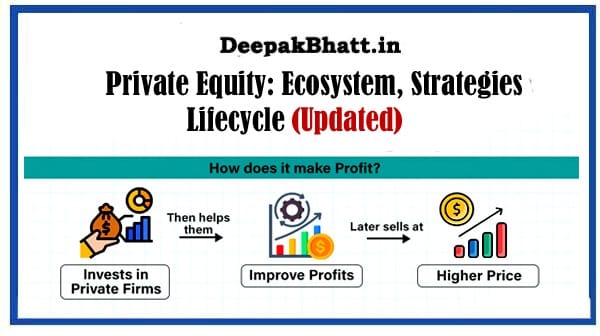

At its essence, Private Equity represents a category of investment where funds are directly invested in private companies that are not publicly traded on stock exchanges.

This stands in contrast to public equity, where investors trade shares of publicly listed companies. Private equity investments are typically illiquid, involving a longer investment horizon compared to their publicly traded counterparts.

The primary goal of private equity is to fuel growth, enhance operational efficiency, and ultimately yield substantial returns on investment.

The Players in the Private Equity Ecosystem

To truly understand the dynamics of private equity, it’s crucial to recognize the key players involved in this financial ecosystem.

1. Private Equity Firms:

At the forefront are private equity firms, entities that actively manage and deploy capital in private companies.

These firms are instrumental in sourcing investment opportunities, conducting due diligence, and implementing strategic initiatives to drive growth.

Private equity firms operate with distinct strategies, such as venture capital for early-stage companies, buyouts for mature companies, or growth equity for businesses in need of expansion capital.

2. Limited Partners (LPs):

Limited partners are the investors in private equity funds. These can range from institutional investors like pension funds, endowments, and insurance companies to high-net-worth individuals and family offices.

LPs commit capital to private equity funds with the expectation of earning attractive returns, albeit with a longer investment horizon compared to traditional asset classes.

3. General Partners (GPs):

The individuals or teams managing private equity funds are known as general partners. GPs play a critical role in the success of the fund by making investment decisions, implementing operational improvements in portfolio companies, and eventually exiting investments to realize returns.

GPs typically earn management fees and a share of the profits, aligning their interests with those of the limited partners.

Investment Strategies

It’s encompasses a spectrum of investment strategies tailored to the unique needs and stages of companies. Understanding these strategies provides insight into the diverse approaches that private equity firms employ.

1. Venture Capital (VC):

Venture capital focuses on investing in early-stage and high-growth companies with significant potential for innovation and market disruption.

VC firms often take minority stakes in these companies, providing crucial funding for product development, market expansion, and other strategic initiatives.

2. Buyouts:

Buyout strategies involve acquiring a controlling interest in established companies, often with the goal of restructuring, improving efficiency, and ultimately increasing the company’s value.

Leveraged buyouts (LBOs) are a common subset of buyout transactions, where a significant portion of the acquisition is funded through debt.

3. Growth Equity:

Growth equity strikes a balance between venture capital and buyouts, targeting companies in the growth phase that require capital for expansion but are not necessarily in need of a complete restructuring.

Growth equity investments support companies in scaling operations, entering new markets, and executing strategic initiatives.

Investment Lifecycle

It’s investments undergo a distinct lifecycle, each phase playing a crucial role in the ultimate success of the investment.

1. Sourcing and Due Diligence:

This initial phase involves identifying potential investment opportunities and conducting due diligence to assess the viability and risks associated with a particular investment.

Private equity firms meticulously analyze financials, management teams, market dynamics, and growth prospects during this stage.

2. Deal Structuring and Investment:

Once a promising opportunity is identified, the private equity firm structures the deal, determining the terms of the investment.

This may involve negotiating valuation, governance structures, and the extent of control the private equity firm will have over the portfolio company.

3. Active Management and Value Addition:

Post-investment, private equity firms actively engage in managing and enhancing the value of their portfolio companies.

This involves implementing strategic initiatives, operational improvements, and, in some cases, changes in leadership to optimize the company’s performance.

4. Exit Strategy:

Private equity investments are not perpetual. The ultimate goal is to exit the investment and realize returns.

Common exit strategies include selling the portfolio company to a strategic buyer, conducting an initial public offering (IPO), or merging with another company.

Risk and Returns

Investments come with a unique set of risks and rewards. Understanding this dynamic is crucial for both investors and private equity firms.

Risks:

- Illiquidity: PE investments are typically illiquid, meaning that investors may not have immediate access to their capital.

- Market and Economic Risks: PE investments are influenced by macroeconomic factors, industry trends, and market conditions.

- Operational Risks: The success of an investment depends on the ability of the PE firm to implement effective operational improvements in portfolio companies.

Rewards:

- High Returns: It has the potential to deliver higher returns compared to traditional asset classes, especially when successful in enhancing the value of portfolio companies.

- Diversification: For investors offers diversification benefits by providing exposure to a different risk-return profile compared to public equities and fixed-income securities.

- Active Management: The hands-on approach into firms allows for active management and strategic interventions to drive value.

Challenges and Controversies

Despite its prominence, private equity is not without challenges and controversies. Scrutiny over issues like excessive leverage, job cuts in portfolio companies, and the potential for short-term profit-taking has sparked debates within the financial community and beyond.

Balancing the interests of investors, portfolio companies, and broader stakeholders remains a persistent challenge.

The Future

The landscape of private equity is evolving, influenced by global economic trends, technological advancements, and societal shifts.

As sustainable investing gains traction, private equity firms are increasingly focusing on Environmental, Social, and Governance (ESG) considerations.

The integration of technology, data analytics, and artificial intelligence is also reshaping how private equity firms identify opportunities, conduct due diligence, and manage their portfolios.

Conclusion

In conclusion, private equity stands as a multifaceted and influential force in the world of finance and investment.

From venture capital supporting groundbreaking innovations to buyouts revitalizing established companies, private equity plays a pivotal role in shaping the destiny of businesses.

The dance between risk and return, the intricacies of deal structuring, and the active management of portfolio companies define the private equity experience.

As this dynamic realm continues to evolve, understanding the nuances of it’s becomes paramount for investors, entrepreneurs, and finance enthusiasts alike.

It represents not only an investment strategy but a transformative force that propels businesses forward and drives economic growth